What Are the Three Responsibilities of the Federal Reserve System

The Federal Reserve System often referred to as the Federal Reserve or simply the Fed is the central bank of the United States. - protecting consumers through regulation and education.

The Federal Reserve In Action Ppt Download

What are the three responsibilities of the Federal Reserve System.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Role_of_the_Fed_Jun_2020-01-02efe1c99128421195f2a3c68737d792.jpg)

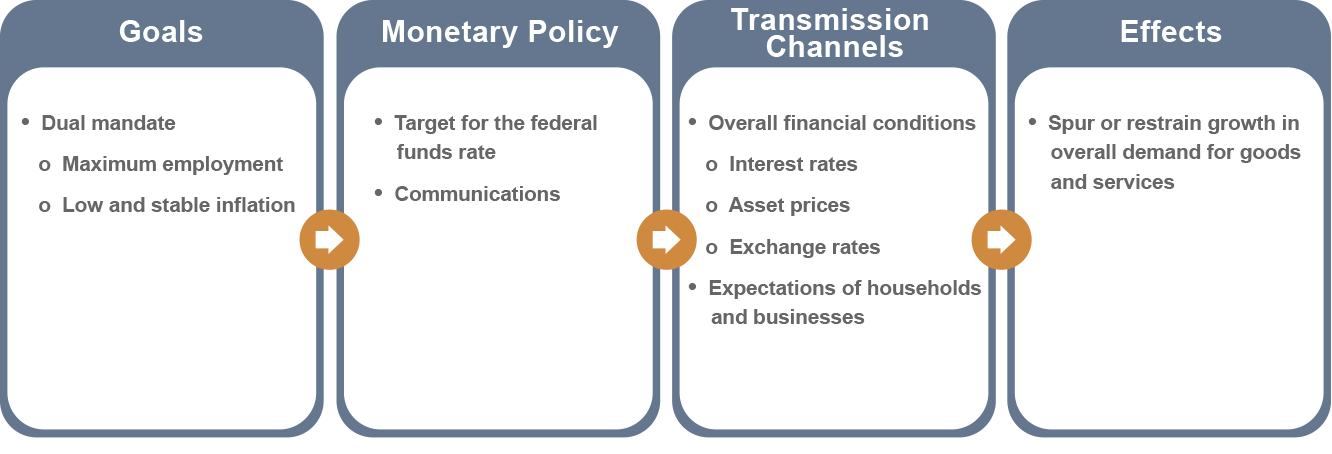

. Promotes the stability of the financial system and seeks to minimize and contain systemic risks through active monitoring and engagement in the US. Economy and the stability of the US. Monetary Policy Banking Supervision Financial Services Board of Governors The Board of Governors located in Washington DC provides the leadership for the System.

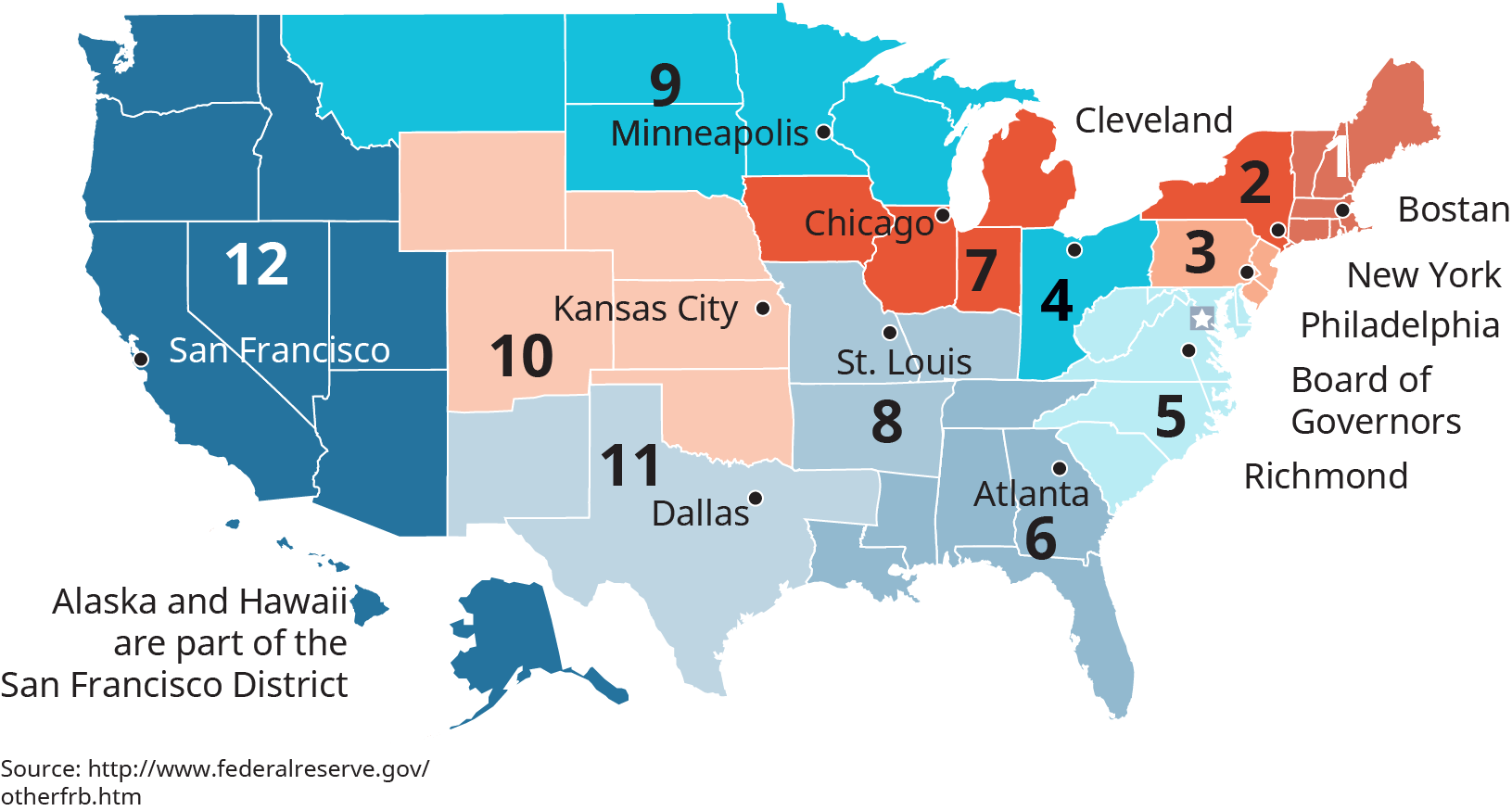

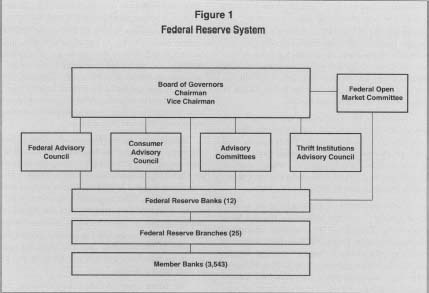

Conducts the nations monetary policy to promote maximum employment stable prices and moderate long-term interest rates in the US. The Federal Reserve the central bank of the United States provides the nation with a safe flexible and stable monetary and financial system. Three key components of the Federal Reserve Systemthe Federal Reserve Board of Governors Board of Governors the Federal Reserve Banks.

Six branches with overlapping responsibilities c. He Federal Reserve Systems responsibilities include. Central bank and in that role performs three primary functions.

It oversees the financial services industry and works to keep prices stable by initiating monetary policies based on forecasts of the economic future. Conducting monetary policy d. Loan money to corporations that want to raise capital.

And establishing monetary policies. The Federal Reserve Board of Governors in Washington DC. Manage the nations currency supply.

The Federal Reserve acts as the US. Maintaining an effective reliable payment system. Providing services to depository institutions the federal government and the public.

The Federal Reserve Chairs duties include testifying before Congress meeting with the Treasury Secretary and chairing the Federal. The Board of Governors the Federal Reserve Banks and the Federal Open Market Committee work together to promote the health of the US. Supervising and regulating bank operations.

The Federal Reserve System is composed of. Central bank and in that role performs three primary functions. Provide banking and loan services to individual Americans.

What are the responsibilities of the Federal Reserve. Regulating and supervising financial institutions. The Federal Reserve System Purposes Functions 1 he Federal Reserve System is the central bank of the United States.

The Federal Reserve was created on December 23 1913 when President Woodrow Wilson signed the. Lending money to consumers b. The Federal Reserve conducts the nations monetary policy to promote maximum.

The responsibilities of the Federal Reserve include influencing the supply of money and credit. Three major responsibilities of The Federal Reserve are stabilizing prices interest rate adjustments conducting investigationsshow more content Also known as Cash Reserve Ratio it is the percentage of deposits which commercial banks are required to keep as cash according to the directions of the central bank. The Federal Reserve has three primary functions.

The Federal Reserve can change the money supply with 1 open market operations 2making changes in the reserve ratio and 3 making changes in the discount rate. Economy and more generally the public interest. The Federal Reserve acts as the US.

Supervising and regulating financial institutions. What other random duties do the Federal Reserve perform. Five branches with clear responsibilities b.

Which of the following is not one of the three responsibilities of the Federal Reserve System. Regulate and supervise the American banking industry. It was created by the Congress to provide the nation with a safer more flexible and more stable monetary and financial system.

Foster stability in financial markets and to ensure compliance with applicable laws and regulations. Introduction to the Federal Reserve System 1 s the central bank of the United States the Federal Reserve System Federal Reserve or System conducts the nations monetary policy and helps to maintain a stable financial system. It performs five general functions to promote the effective operation of the US.

Serving as a banking and fiscal agent for the United States government. Supervising and regulating bank operations. December 11 2021 The Feds main duties include conducting national monetary policy supervising and regulating banks maintaining financial stability and providing banking services.

And establishing monetary policies. Board of Governors of the Federal Reserve System. - processing checks and electronic payments.

Check all that apply. Three branches with overlapping responsibilities. The Federal Reserve System is responsible for maintaining the health of the banking and financial systems.

Loan money to banks in a crisi. Maintaining an effective reliable payment system. - supply paper money and coin to banks.

And supplying payments services to the public through depository institutions like banks credit. Of the three policies the open.

About The Fed An Introduction To The U S Central Bank Federal Reserve History

The Federal Reserve System And Central Banks Macroeconomics

/The-federal-reserve-system-and-its-function-3306001_final-7ed205221ee243f0bfa72b8b27226282.png)

ابدأ اذهب للمشي الجلسة العامة Federal Reserve Bank Responsibilities Tafraa Com

The Role Of The Federal Reserve Wsu Online Mba

Federal Reserve Board Monetary Policy What Are Its Goals How Does It Work

Federal Reserve Definition Forexpedia By Babypips Com

Federal Reserve System Frs Definition

The Federal Reserve System Introduction To Business

ابدأ اذهب للمشي الجلسة العامة Federal Reserve Bank Responsibilities Tafraa Com

Federal Reserve Board Federal Reserve Banks

/dotdash_Final_Federal_Reserve_Bank_of_San_Francisco_May_2020-01-6fc5b14f38a34fd4be857e1fe090d7eb.jpg)

Federal Reserve Bank Of San Francisco

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Role_of_the_Fed_Jun_2020-01-02efe1c99128421195f2a3c68737d792.jpg)

Federal Reserve System Frs Definition

/GettyImages-678686302_1800-1c1c3a0c9f554ec68982781751a74a3e.png)

Federal Reserve System Frs Definition

/GettyImages-699686820-a630c3fcc96441e1ab8a0d2441731efb.jpg)

What Do The Federal Reserve Banks Do

Structure Of The Federal Reserve System Wikipedia

/Marriner_S._Eccles_Federal_Reserve_Board_Building-de8873dfb7104939a49c2a17a1729e9f.jpg)

Understanding The Federal Reserve Balance Sheet

:max_bytes(150000):strip_icc()/Clipboard01-5f81c3d8028b4eb8b1fc5f704d05ea75.jpg)

Comments

Post a Comment